Inventory valuation is a critical aspect of financial management for businesses across various industries. It refers to assigning a monetary value to a company’s goods in stock. Accurate inventory valuation is essential as it directly impacts financial statements, tax calculations, and overall business decision-making.

Understanding the Basics of Inventory Valuation is crucial for entrepreneurs, accountants, and managers to maintain a clear and transparent financial picture. In this blog, we will delve into the fundamental concepts of inventory valuation, exploring different methods such as FIFO, LIFO, and weighted average, providing valuable insights to enhance inventory management strategies and optimize profitability.

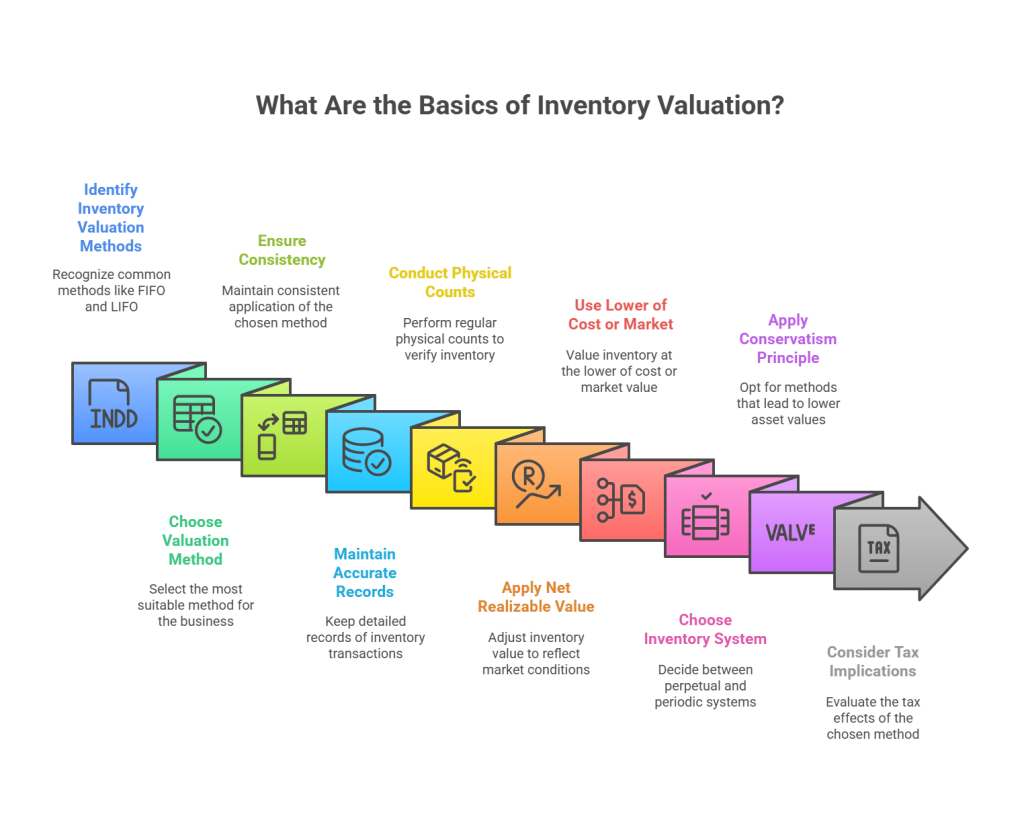

What Are the Basics of Inventory Valuation?

Inventory valuation is determining the monetary value of the goods and materials held in a company’s inventory at a specific time. It is crucial for businesses to accurately value their inventory as it directly impacts financial statements and profitability. There are various ways to value inventory, each with benefits and drawbacks.

The most common inventory valuation methods are the First-In-First-Out (FIFO), Last-In-First-Out (LIFO), Weighted Average Cost, and Specific Identification methods. Proper inventory valuation enables businesses to make informed pricing, production, and overall financial health decisions.

Some of the key significance of inventory valuation include:

1. Cost Method Selection

Choosing the best inventory valuation method is crucial as it directly affects the calculation of cost of goods sold (COGS) and ending inventory. Different methods have different implications on financial statements and tax liabilities. For example, in the FIFO method, it is assumed that the first items added to inventory are the first ones sold, while in the LIFO method, it is assumed that the last items added are the first sold. Weighted Average Cost method, as the name suggests, calculates the average cost of all units in inventory. Specific Identification method assigns actual costs to individual items. The choice of method should align with the nature of the business and industry norms.

2. Consistency

Consistency is vital in inventory valuation to ensure accurate financial reporting and meaningful year-to-year comparisons. Companies should stick to one inventory valuation method and apply it consistently over time. Frequent changes in valuation methods can lead to misleading financial statements and make it difficult for stakeholders to assess performance trends.

3. Accurate Record-Keeping

Accurate and comprehensive record-keeping of inventory transactions, including purchases, sales, returns, and adjustments, is essential. It helps in tracing the movement of inventory and ensures that the values recorded in the accounting system align with physical stock levels. Good record-keeping also aids in identifying any discrepancies that may arise during audits.

4. Physical Counts

Conducting regular physical counts of inventory is essential to verify the recorded quantities and to identify any potential issues like theft, pilferage, or inaccuracies in tracking. Periodic physical counts can help businesses keep their inventory data accurate and up-to-date.

5. Net Realizable Value (NRV)

When the value of inventory declines due to obsolescence, damage, or other factors, it is necessary to adjust its value to its Net Realizable Value (NRV). NRV is the estimated selling price minus the estimated costs to complete and sell the inventory. Adjusting inventory to its NRV ensures a conservative approach to valuation, preventing overstatement of assets.

6. Lower of Cost or Market (LCM)

The Lower of Cost or Market (LCM) rule is activated when an item’s market value is less than its historical cost. In these situations, businesses ought to write off the inventory at either its cost or its current market value, whichever is lower. With the use of this measure, inventory is kept from being valued higher on the balance sheet than it is actually worth.

7. Perpetual vs. Periodic Inventory Systems

Businesses can adopt either perpetual or periodic inventory systems. In a permanent system, technology keeps track of inventory in real-time and reports the most recent stock levels following each transaction. A periodic approach, on the other hand, involves sporadic physical counts, and businesses routinely update the inventory balance.

The choice of system impacts the accuracy and efficiency of inventory valuation.

8. Conservatism Principle

The conservatism principle in accounting suggests that when there are uncertainties or doubts, companies should opt for the method that leads to lower asset values and lower income. Applying conservative inventory valuation methods ensures a more cautious approach, preventing overestimation of inventory values

9. International Financial Reporting Standards (IFRS) vs. Generally Accepted Accounting Principles (GAAP)

Different countries may follow different accounting standards such as IFRS or GAAP. These standards may influence the inventory valuation approach, especially when dealing with multinational companies or reporting across different jurisdictions.

10. Tax Implications

Inventory valuation directly affects tax calculations. In some countries, tax regulations mandate specific inventory valuation methods for reporting purposes. Businesses need to consider the tax implications of their chosen method to comply with local tax laws and optimize tax liabilities.

By understanding and applying these key features, businesses can accurately value their inventory, leading to better financial decision-making and improved overall performance.

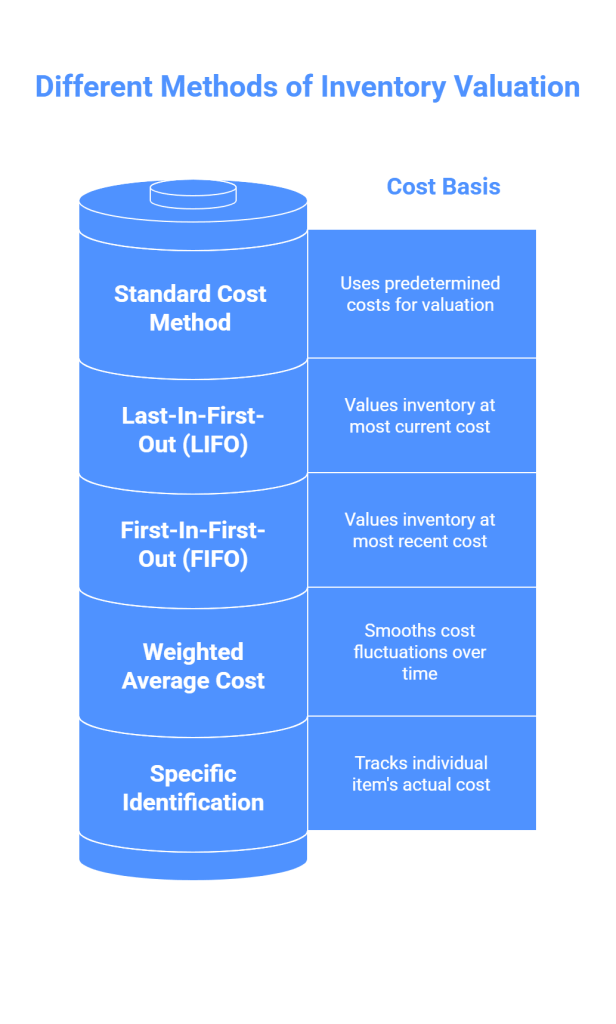

Different Methods of Inventory Valuation

There are various methods of inventory valuation used in accounting and financial reporting. Here are five different methods:

1. First-In-First-Out (FIFO)

FIFO makes the assumption that businesses will sell the first products they buy.

This method values the ending inventory at the most recent cost and computes the cost of goods sold (COGS) using the oldest inventory cost. It is typically used in firms that deal with perishable items or products with a short shelf life and generally corresponds with the real physical flow of goods in most industries. FIFO offers a better representation of the inventory’s current market value, especially during inflation.

2. Last-In-First-Out (LIFO)

LIFO assumes that the last items purchased are the first to sell. As a result, businesses value ending inventory at the oldest cost and determine the cost of goods sold (COGS) using the most current inventory cost.

LIFO can be advantageous during periods of inflation because it assigns higher costs to COGS, potentially reducing taxable income. However, it may need to reflect the physical flow of goods in many industries accurately.

3. Weighted Average Cost

The weighted average cost method calculates the average cost of all units available for sale during a specific period. This average cost is then used to value the ending inventory and the cost of goods sold. The calculation involves dividing the total cost of goods for sale by the total number of units available for sale. The method is straightforward and smooths out cost fluctuations over time, providing a cost allocation that represents a blend of different purchase prices.

4. Specific Identification

The particular identification method involves individually tracking and valuing each item in the inventory based on its actual cost. This method suits businesses dealing with unique, high-value, or easily distinguishable items. Specific identification provides the most accurate reflection of the cost of each item sold and remaining in inventory. However, it can be not very easy and may not be practical for companies with many identical products.

5. Standard Cost Method

The standard cost method involves predetermining standard costs for materials, labor, and overhead. Companies determine these standard costs using past data and predicted expenditures. They compare the actual costs to the standard costs during the accounting period and record the discrepancy (variance).

The standard cost method allows for better cost control and performance evaluation by comparing actual costs to the expected standard costs. Each inventory valuation method has its advantages and disadvantages, and the choice of method can significantly impact financial statements and tax liabilities. Businesses need to carefully consider their specific circumstances, industry norms, and accounting standards to select the most appropriate method for their inventory valuation.

Companies should also use the chosen approach consistently to guarantee accurate and trustworthy financial reporting.

Conclusion

Inventory valuation is crucial for accurate financial reporting and decision-making. The two main methods, FIFO and LIFO, play a pivotal role in determining the value of goods held in stock. Qodenext offers expert guidance and advanced inventory management software to streamline processes, optimize stock levels, and enhance efficiency. With Qodenext’s support, businesses can effectively manage their inventory, comply with accounting standards, and make informed decisions for a successful future.

FAQs: Inventory Valuation – Basics, Methods, and Best Practices

1. What is inventory valuation and why is it important?

Inventory valuation is the process of assigning a monetary value to the goods and materials a business holds in stock at a specific time. It’s important because it directly affects key financial statements, tax calculations, profitability assessment, and business decision-making. Accurate valuation ensures transparent reporting and compliance with accounting and tax standards.

2. What are the most common inventory valuation methods?

The main inventory valuation methods are:

- FIFO (First-In-First-Out): Assumes the first items purchased are the first sold.

- LIFO (Last-In-First-Out): Assumes the most recently acquired items are sold first.

- Weighted Average Cost: Values all units at the average cost for the period.

- Specific Identification: Tracks and assigns actual costs to specific items.

- Standard Cost: Uses predetermined costs for materials, labor, and overhead.

3. How do FIFO and LIFO differ in financial reporting?

FIFO results in lower cost of goods sold (COGS) and higher ending inventory values during inflation, potentially increasing taxable income. LIFO results in higher COGS and lower ending inventory during inflation, often reducing taxable income. The method chosen can affect profitability metrics and tax liability.

4. What factors should influence the selection of an inventory valuation method?

Businesses should consider industry standards, the nature of their products (e.g., perishable vs. durable), cost fluctuation patterns, regulatory requirements (GAAP/IFRS), and tax implications. Consistency in application year to year is also important for relevant comparisons and reliable reporting.

5. Why is consistency important in inventory valuation?

Using the same valuation method over time promotes comparability in financial reports, helping stakeholders track performance trends and make accurate assessments. Frequent changes can distort financial results and reduce credibility with auditors and investors.

6. What role does accurate record-keeping play in inventory valuation?

Thorough record-keeping of purchases, sales, returns, and adjustments ensures recorded inventory values match physical stock levels. It helps detect discrepancies, prevents errors in financial statements, and supports reliable audits.

7. What are the key differences between perpetual and periodic inventory systems?

- Perpetual systems update inventory levels in real-time after every transaction, offering the most current stock information and streamlined valuation.

- Periodic systems rely on regular physical counts and periodic updates, which may increase the risk of discrepancies but can be simpler for small businesses.

8. How are declines in inventory value handled?

When inventory value drops due to obsolescence, damage, or market factors, companies must reduce values to Net Realizable Value (NRV) or under the Lower of Cost or Market (LCM) rule. This ensures assets are not overstated and financial statements remain conservative and accurate.

9. Are there differences in inventory valuation under IFRS and GAAP?

Yes. For example, IFRS prohibits the use of LIFO, whereas it is allowed under US GAAP. These differences can affect how multinational companies report and value inventory in different regions.

10. How does inventory valuation impact taxes?

The method chosen for inventory valuation affects the cost of goods sold, taxable income, and ultimately the company’s tax liability. Some jurisdictions require or restrict certain methods, making it essential for businesses to consider local tax regulations when selecting and applying inventory valuation strategies.