Supply chain managers must protect their warehouse assets to stay relevant. Whether you own a small storage facility or operate a large-scale distribution center, warehouse insurance is an essential safeguard against financial losses due to unforeseen events such as theft, natural disasters, or operational disruptions.

As we move into 2025, businesses must stay informed about the latest trends, policies, and coverage options to make the right insurance choices. This comprehensive guide will provide an in-depth understanding of warehouse policy, including its importance, key coverage types, and best practices for choosing the right policy.

What is Warehouse Insurance?

Warehouse coverage is a specialized type of business insurance that protects warehouse owners, operators, and tenants against risks such as property damage, inventory loss, liability claims, and business interruptions. It ensures financial security by covering repair costs, replacement expenses, and legal liabilities arising from accidents or disasters within a warehouse facility.

Types of Warehouse Insurance Policies

- Property Insurance – Covers damages to the warehouse structure, equipment, and inventory due to fire, storms, or vandalism.

- Cargo Insurance – Protects goods stored in the warehouse against theft, fire, or transit-related losses.

- Liability Insurance – Provides coverage in case of accidents, injuries, or lawsuits involving employees or third parties.

- Business Interruption Insurance – Compensates for lost revenue due to temporary closure or operational disruptions.

- Equipment Breakdown Insurance – Covers repair or replacement costs for machinery and automation tools in the warehouse.

- Theft and Crime Insurance – Protects against financial loss due to burglary, employee theft, or cyber fraud.

Why is Warehouse Insurance Important?

The need for warehouse insurance goes beyond basic risk management. Here’s why it’s crucial for businesses in 2025:

1. Protection Against Financial Loss

Without proper insurance, damage from natural disasters, fires, or theft can result in significant financial setbacks. Warehouse insurance ensures you don’t bear these costs alone.

2. Compliance with Industry Regulations

Many industries require warehouse storage insurance to comply with legal and contractual obligations.

3. Safeguarding Business Reputation

An uninsured warehouse incident can disrupt supply chains, delay deliveries, and impact client trust. Policies like inventory and shipping insurance help maintain business continuity.

4. Employee and Customer Safety

Liability coverage protects against injury-related claims, ensuring a safe working environment and mitigating legal risks.

5. Cybersecurity and Digital Protection

With increasing digital integration in warehouses, insurance policies now cover cyber threats, protecting sensitive data and financial transactions.

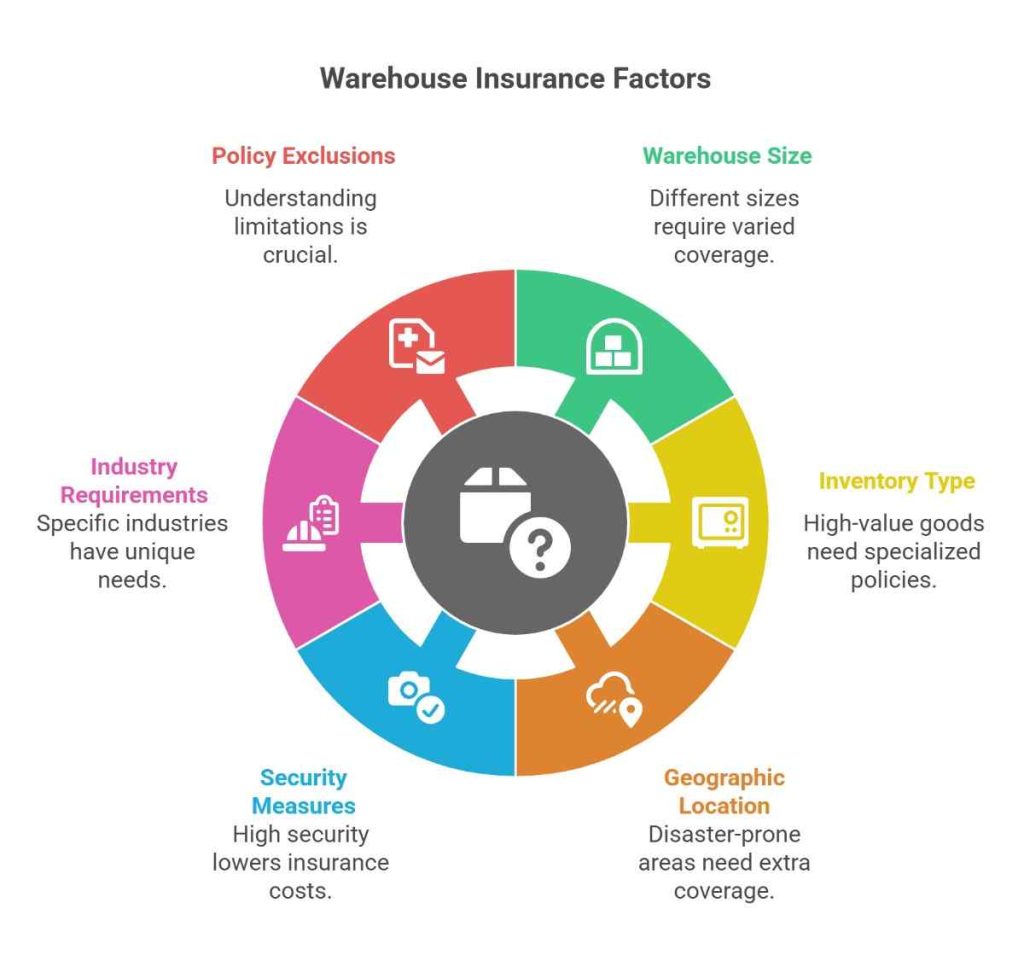

Key Factors to Consider When Choosing Warehouse Insurance

Selecting the right warehouse insurance policy involves evaluating multiple factors to ensure comprehensive coverage:

1. Warehouse Size and Type

Different warehouses require different coverage. A large automated facility may need additional policies compared to a smaller manually operated warehouse.

2. Inventory Type and Value

High-value goods such as electronics or pharmaceuticals require specialized insurance coverage compared to perishable or bulk commodities.

3. Geographic Location

Warehouses in flood-prone or earthquake-prone areas may need additional coverage for natural disasters.

4. Security Measures

Insurers assess the security level of your warehouse, including surveillance, fire suppression systems, and access controls.

5. Industry-Specific Requirements

Some industries, like pharmaceuticals or food storage, have stringent insurance needs, including compliance with health and safety regulations.

6. Policy Exclusions and Limitations

Check the terms and conditions of your insurance policy. Be aware of exclusions such as intentional damage, normal wear and tear, or war-related losses.

Warehouse Insurance Costs and Premiums in 2025

The cost of inventory insurance varies based on several factors:

- Warehouse Size – Larger warehouses with extensive operations generally have higher premiums.

- Inventory Value – High-value goods require more coverage, leading to higher costs.

- Location Risk Factors – Warehouses in high-risk areas may face increased premiums.

- Security Measures – Advanced security features can reduce insurance costs by minimising risk.

- Claim History – Warehouses with a history of frequent claims may face higher premiums.

Estimated Premium Ranges in 2025:

- Small warehouse: 3,000 – 8,000 per year

- Medium warehouse: 10,000 – 25,000 per year

- Large warehouse: 30,000+ per year

Best Practices for Warehouse Insurance in 2025

To maximise protection and minimise costs, follow these best practices:

- Conduct Regular Risk Assessments – Identify vulnerabilities and address potential hazards before they lead to claims.

- Invest in Security Upgrades – Install advanced security systems such as biometric access controls, motion detectors, and AI-powered surveillance to deter theft and vandalism.

- Maintain Detailed Inventory Records – Use warehouse management software (WMS) to track stock levels and ensure accurate documentation for claims processing.

- Compare Multiple Insurance Providers – Obtain quotes from different insurers, review policy terms, and negotiate better coverage.

- Train Employees on Safety Protocols – Implement structured safety programs to reduce workplace accidents and potential liability claims.

- Implement Fire Prevention Measures – Install modern fire suppression systems, conduct regular safety drills, and comply with fire code regulations.

- Ensure Proper Cargo Handling – Train employees on safe handling techniques and secure storage methods to prevent damage or loss.

- Review and Update Policies Annually – Business needs evolve, and so should your insurance coverage. Conduct annual policy reviews to ensure continued protection.

- Bundle Policies for Cost Efficiency – Many insurers offer bundled policies, combining property, liability, and cargo insurance for better pricing and broader coverage.

- Work with an Insurance Broker – Brokers can provide valuable insights into industry-specific risks and help tailor a policy that aligns with your warehouse operations.

Conclusion

As warehouse operations continue to evolve in 2025, having the right warehouse insurance is critical for protecting your business, assets, and reputation. By understanding policy options, coverage requirements, and best practices, you can make informed decisions that safeguard your warehouse against potential risks.

Ensure that your warehouse risk policy is up-to-date and provides comprehensive protection, so your business remains resilient and prepared for any challenges ahead. For further assistance in supply chain optimization, contact Qodenext today.

FAQs – Warehouse Insurance

1. What does warehouse policy typically cover?

Warehouse policies cover property damage, inventory loss, business interruptions, liability claims, and equipment breakdowns. Additional coverage may include theft protection, cyber liability, and disaster recovery.

2. How can I lower my warehouse policy costs?

Implement security measures, maintain accurate inventory records, bundle multiple policies, and work with an insurance broker to negotiate better rates.

3. Do I need separate coverage for warehouse employees?

Yes, workers’ compensation insurance is necessary to cover employee injuries, medical expenses, and lost wages due to workplace accidents.

4. Does warehouse insurance cover customer-owned inventory?

Many policies offer coverage for third-party goods stored in the warehouse, but it’s essential to check policy details and exclusions.

5. What happens if my warehouse experiences a cyberattack?

Cyber liability insurance can help cover financial losses, legal fees, and data recovery costs associated with cyberattacks on warehouse management systems.

6. How frequently should I review my warehouse insurance policy?

Review your policy at least once a year or whenever there are significant changes in operations, inventory value, or risk factors.