In a competitive economy, organisations and individuals are continually seeking ways to maximise returns, minimise risks, and maintain long-term financial stability. One critical practice that ties all these goals together is resource management. But before diving into the nuances, let’s start with the fundamental question: what is asset management?

Defining Asset Management

At its core, management refers to the systematic process of developing, operating, maintaining, and cost-effectively selling assets. Assets may include anything of value that an individual or organisation owns—ranging from financial securities like stocks and bonds to physical infrastructure, intellectual property, or real estate.

When you ask, “What is asset management?” in a financial context, the answer typically focuses on investment management: professional services offered by firms or advisors who manage client portfolios to achieve specific financial objectives. In a broader business context, however, it also encompasses the management of physical assets to optimise performance, reduce costs, and extend life cycles.

The Importance of Asset Management

Why does asset optimization matter so much today? Let’s look at its key significance:

1) Maximising Value

Assets are not static. They appreciate or depreciate over time. Effective management ensures that assets generate the highest possible return throughout their lifecycle.

2) Risk Mitigation

By monitoring market conditions, technological shifts, and asset performance, asset managers help reduce exposure to financial or operational risks.

3) Strategic Planning

Infrastructure optimisation creates a roadmap that aligns investments with long-term organisational or personal goals. Companies like OPC Asset Solutions handle lifecycle management.

4) Regulatory Compliance

For businesses, product lifecycle management also means adhering to accounting standards, environmental laws, and industry regulations.So, when people explore “what is asset management?”, they are also exploring strategies for efficiency, resilience, and growth.

What Are the Types of Asset Management?

Value management is not a one-size-fits-all practice. It branches into multiple categories depending on the nature of the assets being managed:

1. Financial Management

This is the most widely recognised form. Financial asset managers oversee investments such as equities, bonds, mutual funds, ETFs, and alternative investments. Their goal is to generate consistent returns while balancing risk according to the client’s risk tolerance.

2. Enterprise Management

In the corporate sphere, companies manage physical asset tracking, such as machinery, IT infrastructure, or fleets. EAM focuses on maintenance schedules, lifecycle management, and cost optimisation.

3. Real Estate Management

Real estate investors rely on resource management to increase property value, manage tenants, optimise rental income, and determine the right time to buy or sell properties.

4. Digital Management

With the explosion of digital content, businesses also need systems to manage digital assets—photos, videos, brand files, and intellectual property. DAM solutions ensure accessibility, security, and consistency.

5. Wealth and Private Management

This type involves high-net-worth individuals or families where managers create personalised strategies for estate planning, tax efficiency, and generational wealth transfer.

Each type offers a unique answer to the question, “What is asset management?” depending on the assets in focus.

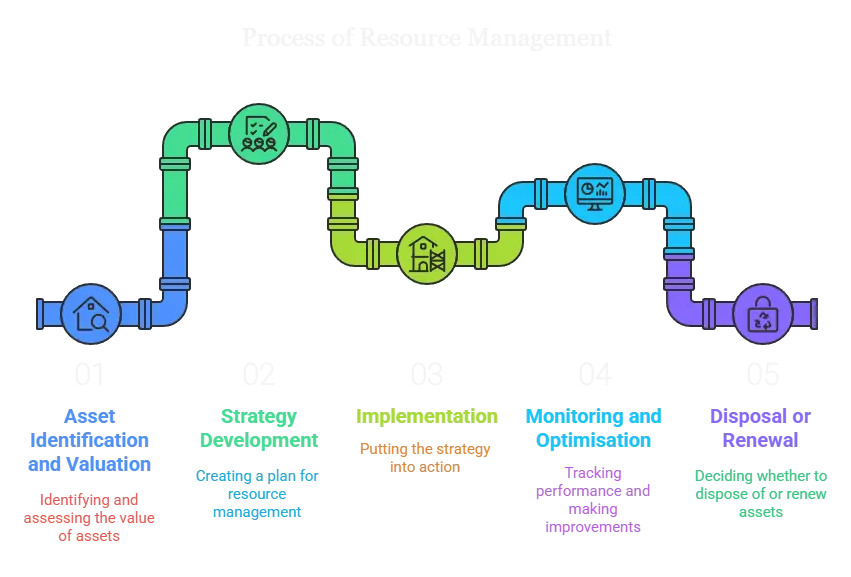

The Process of Resource Management

While tools and strategies differ, the core process remains structured:

1) Asset Identification and Valuation

There are stages of the procurement lifecycle. The first step is cataloguing all assets and determining their current value.

2) Strategy Development

Based on financial goals, risk appetite, and time horizon, an asset allocation strategy is created.

3) Implementation

Assets are purchased, allocated, or deployed. For physical assets, this could mean setting up systems for monitoring usage and performance.

4) Monitoring and Optimisation

Continuous performance tracking ensures that assets are delivering expected returns or utility. Adjustments are made as markets or conditions change. Companies are also investing in asset tracking software to monitor gaps.

5) Disposal or Renewal

Assets nearing the end of their lifecycle are either liquidated, replaced, or upgraded.

When viewed as a cycle, the process emphasises not just ownership but also proactive stewardship. In other words, answering “what is asset optimisation?” means understanding a lifecycle approach, not a one-time activity.

Tools and Technologies in Asset Optimisation

Modern management is heavily supported by technology. Some of the most widely used tools include:

- Portfolio Management Software for investors to track securities.

- Enterprise Management Systems that integrate maintenance, procurement, and lifecycle tracking.

- Data Analytics & AI for predictive insights into asset performance and market trends.

- Cloud-Based Digital Asset Platforms that centralise access to creative and intellectual assets.

The question “what is value management?” today cannot be answered without mentioning the role of digital transformation, which makes the process faster, smarter, and more transparent.

Benefits of Asset Toolkit Management

Organisations and individuals who implement management practices effectively gain several advantages:

- Optimised Resource Allocation: Ensuring capital is directed toward the highest-yielding opportunities.

- Enhanced Transparency: Clear visibility into the status and value of all assets.

- Cost Savings: Proactive management reduces maintenance costs and avoids sudden breakdowns.

- Stronger Decision-Making: Data-driven insights support better strategic choices.

- Sustainability: Responsible management includes considering environmental and social impacts.

So, what is asset management? It is not just about safeguarding wealth—it is about creating a sustainable system where assets contribute consistently to overall objectives.

Challenges in Asset Management

Despite its benefits, value management faces hurdles:

- Market Volatility – Financial asset managers constantly deal with uncertainty in global markets.

- Data Overload – With digital systems, organisations struggle to manage the sheer volume of data generated.

- Regulatory Complexity – Compliance requirements vary across regions and asset classes.

- Cybersecurity Risks – Especially in digital asset management, safeguarding data is a growing challenge.

- Lifecycle Uncertainty – Predicting when to replace or dispose of assets is not always straightforward.

Each challenge reaffirms why asking “what is enterprise management?” is critical—because effective strategies evolve to counter these complexities.

Future of Asset Management

The future of asset management is being shaped by three major trends:

- Artificial Intelligence & Automation: AI algorithms now recommend investment strategies, predict asset failures, and even automate maintenance scheduling.

- Sustainability & ESG Integration: Environmental, social, and governance factors are now central to investment and operational decisions.

- Blockchain & Tokenisation: Digital tokens are transforming how financial and physical assets are tracked, traded, and authenticated.

The evolving answer increasingly involves technology, ethics, and global integration.

Conclusion

So, what is asset management? It is the discipline of systematically managing assets—whether financial securities, physical equipment, real estate, or digital content—to deliver maximum value over time. By blending strategy, technology, and foresight, management ensures that resources not only preserve their worth but also actively contribute to growth and sustainability.

Explore advanced traceability and automation technologies for your logistics with Qodenext today.

FAQs – Asset Management System

1. What is resource management in simple terms?

Resource management is the organised process of managing assets—financial, physical, or digital—to maximise value and minimise risks over time.

2. Who needs resource management?

Both individuals (to grow wealth) and organisations (to optimise operations and investments) benefit from resource management.

3. What skills do asset managers need?

They require financial literacy, risk analysis, data interpretation, regulatory knowledge, and strong decision-making skills.

4. Is resource management only about money?

No. While financial investments are a major part, management also includes managing physical infrastructure, real estate, intellectual property, and digital content.

5. How is asset optimisation different from wealth management?

Wealth management is broader, covering tax planning, estate planning, and holistic financial strategies. Asset optimisation is a specialised subset focusing on managing investments or assets.