In recent times, things in business have been changing a lot. Two ways companies can adapt are called vertical integration and horizontal integration. It’s kind of like deciding how your company fits together. Just as warehouses change to handle more online shopping, businesses need to think about how they want to work.

In this blog, we’ll talk about these two ways companies can organize themselves. We’ll keep it simple and help you understand Vertical Integration vs Horizontal Integration Key Differences. Let’s explore and figure out what might work best for your business in this ever-changing world.

But before we talk about the differences, let’s learn about vertical integration and horizontal integration individually. Let’s start learning!

What is Vertical Integration?:

Vertical integration is a strategic approach to business growth where a company expands by acquiring producers, suppliers, distributors, or other related entities in its supply chain.

The primary goal is to fortify the supply chain, cut production costs, capture additional profits in the upstream or downstream processes, and access new distribution channels.

This strategy involves two firms engaged in similar products or services but at different stages of the production cycle. The integrated firm continues operations on the same product line as before, aiming to gain control over the entire industry.

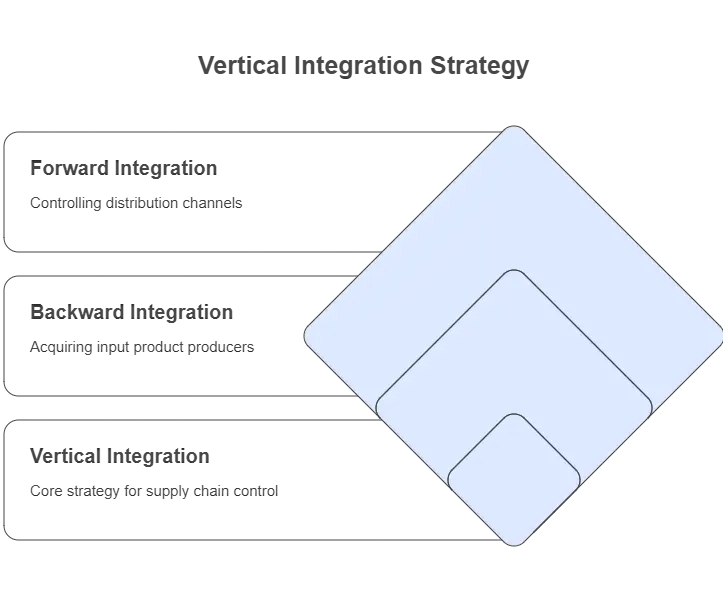

There are two main types of vertical integration:

1. Backward Integration:

Involves acquiring a business that produces input products for the acquiring company. For instance, a car manufacturer achieves backward integration by acquiring a tyre manufacturer.

2. Forward Integration:

This occurs when a company takes control of aspects beyond the production phase, like acquiring dealerships to sell its products directly to consumers. This brings the company closer to consumers and generates additional revenue.

Now let’s learn about horizontal integration.

What is Horizontal Integration?:

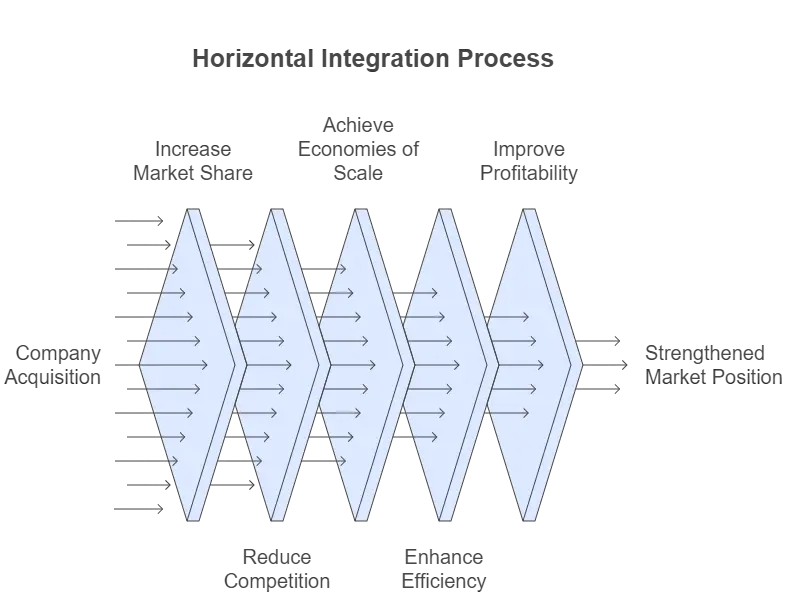

- Horizontal integration is a growth strategy where companies enhance their market position by acquiring or merging with another company operating at the same level of the value chain.

- In simpler terms, it involves two companies offering similar goods or services to a comparable customer base. For instance, a department store chain expands by acquiring another chain in a different location. This strategy not only increases revenue but also broadens market reach.

- Horizontal integration brings cost benefits by sharing technology, marketing efforts, research and development, production, and distribution. The collaboration ideally makes the integrated entity more profitable than its separate counterparts.

- It occurs when two firms engaged in the same line of business and activity level join forces, incorporating products like by-products, complementary items, or related services.

- This strategy minimizes competition and can lead to either a monopoly or an oligopoly in the market, fostering economies of scale. Companies like McDonald’s, Burger King, and Facebook exemplify successful horizontal integration strategies.

Finally, let’s look at some key differences between vertical and horizontal integration, shall we?

Difference Between Vertical Integration and Horizontal Integration:

Here are some brief differences between vertical integration and horizontal integration:

| Point of Difference | Vertical Integration | Horizontal Integration |

| Objectives | Focuses on strengthening and smoothening the production-distribution process by gaining control over various stages of the supply chain. | Aims to increase the size of the business and scale of production, often by merging with or acquiring similar competitors. |

| Capital Requirement | May involve substantial upfront investments to integrate suppliers or distributors, influencing long-term capital requirements. | Often requires significant financial investments to acquire or merge with competitors, impacting the immediate capital outlay. |

| Purpose | Aims to enhance efficiency, control quality, and ensure sustainability by integrating various aspects of the supply chain. | Primarily aimed at expanding market share, eliminating competition, and achieving economies of scale through increased production. |

| Production Scale | Provides higher control over the production process, enabling strategic decision-making and potentially improving overall product quality. | This can lead to increased production capacity, synergies, and improved economies of scale, resulting in cost advantages. |

| Risk | May pose risks related to supply chain disruptions, increased operational complexity, and potential dependence on internal processes. | Carries the risk of increased competition, potential loss of focus on core competencies, and challenges in integrating different organizational cultures. |

| Scope of Control | Aims at having control over specific stages of the supply chain, ensuring a seamless and efficient production process. | Focuses on controlling a broader market segment by acquiring competitors offering similar products or services. |

| Market Presence | May not necessarily impact market presence directly but ensures control over the entire production and distribution network. | Enhances market presence and competitiveness by eliminating rival companies and expanding the customer base. |

| Strategic Focus | Emphasizes internal process control, cost management, and strategic alignment across the supply chain stages. | Places strategic emphasis on market dominance, diversification, and reducing competition through consolidation. |

To further cleary support the points, let’s look at a few examples from each next.

Examples of Vertical Integration:

1. Google and Motorola:

In 2012, Google (Alphabet’s subsidiary) acquired Motorola Mobility, leveraging its pioneering cell phone technology and Android investments.

2. Ikea and Forests in Romania:

Ikea purchased an 83,000-acre woodland reserve in Romania in 2015, marking its foray into managing its forest operations for sustainable wood sourcing.

3. Netflix’s Content Production:

Netflix, once solely a content distributor, embraced vertical integration by producing its original content, reducing dependency on external sources and enhancing revenue.

4. Textile Firms’ Retail Stores:

Companies like Mafatlal and National Textile Corporation opened retail stores to control distribution, ensuring effective management of their supply chain.

Vertical integration attracts antitrust scrutiny, with the FTC monitoring to ensure fair competition and prevent industry dominance. Notable cases include Lockheed Martin’s unsuccessful attempt to acquire Aerojet Rocketdyne. Additional instances involve Walmart’s asset acquisition from JoyRun in 2020 and NVIDIA’s acquisition of Bright Computing in 2022.

Similarly, we have mentioned some examples of horizontal integration below.

Examples of Horizontal Integration:

1. Marriott and Starwood Hotels:

Marriott International acquired Starwood in 2016, creating the world’s largest hotel company, expanding choices for consumers and enhancing shareholder value.

2. Anheuser-Busch InBev and SABMiller:

The $100 billion merger in 2016 aimed to increase market share in developing regions like China, South America, and Africa, complying with antitrust laws by selling off certain beer brands.

3. Disney and 21st Century Fox:

Disney’s 2019 acquisition aimed to grow content, expand internationally, and strengthen direct-to-consumer offerings through ESPN+, Disney+, and Hulu.

Recent horizontal integration instances include Microsoft’s acquisition of Activision Blizzard, JetBlue Airways’ bid for Spirit Airlines, and Baxter International’s purchase of HillRom, demonstrating strategic expansion and synergy benefits.

Conclusion

In the dynamic landscape of business, understanding the nuances of organizational structures is crucial. The comparison between Vertical Integration and Horizontal Integration provides valuable insights into strategic decision-making.

While Vertical Integration seeks internal control and efficiency, Horizontal Integration focuses on market dominance and growth. The key lies in aligning these strategies with specific business objectives. As industries evolve, companies must navigate these choices wisely. Embracing the right integration strategy positions a business for success.

FAQ: Vertical Integration Vs Horizontal Integration: Key Differences

1. Is Nike a vertical or horizontal company?

Nike is primarily a horizontal company. It focuses on design, marketing, and retailing, outsourcing manufacturing to third-party suppliers. This allows Nike to leverage expertise while maintaining flexibility and global reach.

2. Which is more successful horizontal or vertical integration?

Success depends on the industry and strategic goals. Vertical integration offers control over the supply chain, while horizontal integration expands market share. The effectiveness varies based on the company’s objectives and industry dynamics.

3. Is vertical integration cheaper?

Vertical integration can reduce costs by streamlining processes and eliminating intermediaries. However, upfront investments in acquiring and integrating suppliers or distributors may be significant. Long-term cost benefits are influenced by the industry and strategic execution.

4. Is horizontal integration illegal?

Horizontal integration is generally legal, but antitrust laws may intervene if it leads to monopolistic behaviour or harms fair competition. Regulatory bodies scrutinize mergers to ensure they don’t create anti-competitive dominance, protecting market competition and consumer interests.

5. What’s the key difference between vertical and horizontal integration?

Vertical integration means controlling more of your supply chain. Horizontal integration means merging with or acquiring competitors in the same stage of production.

6. Which helps a company grow faster?

Horizontal integration usually speeds up growth by expanding market share, while vertical integration focuses on long-term control and efficiency.

7. Can companies use both strategies?

Companies go vertical when they want more control—over quality, costs, or delivery timelines. It helps them avoid delays, cut out middlemen, and manage their supply chain more smoothly.

8. Why choose vertical integration?

It helps companies control costs, quality, and supply—ideal for improving efficiency and reducing dependency.

9. Why go for horizontal integration?

To reduce competition, increase market reach, and gain economies of scale.

10. Are there risks with these strategies?

Yes, both come with risks. Vertical integration can be costly upfront and may create too much dependence on in-house processes. Horizontal integration can attract antitrust scrutiny and may be challenging if company cultures clash..