Introduction

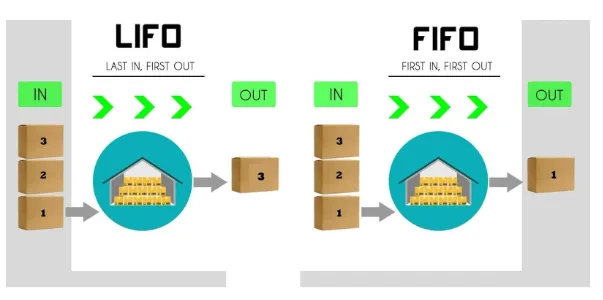

In the ever-evolving realm of financial intricacies and accounting intricacies, the selection of an apt inventory methodology holds substantial sway over your financial outcomes. Two prominently employed approaches, LIFO (Last In, First Out) and FIFO (First In, First Out), emerge as stalwarts in the orchestration of inventory dynamics. Within this exhaustive manual, we shall delve into the subtleties of each methodology, offering tangible instances, dissecting the intricacies of the FIFO inventory method, and shedding light on the LIFO technique through pragmatic illustrations.

Understanding the Basics

- LIFO Unveiled

LIFO, denoting Last In, First Out, functions on the fundamental premise that the most recently incorporated items into an inventory take precedence in sales or consumption. This strategy proves especially advantageous amidst inflationary epochs, serving as a bulwark against elevated costs, thereby diminishing the taxable income footprint.

- Decoding FIFO

Conversely, FIFO, signifying First In, First Out, adheres to a lucid principle: the earliest items in the inventory hierarchy are the initial ones to be dispensed or utilized. FIFO showcases its prowess notably during periods of deflation or unwavering pricing landscapes, mirroring the diminished costs attributed to elder inventory in the computation of COGS.

FIFO and LIFO Examples

Let’s delve into two examples for each inventory method to provide a clearer understanding.

FIFO (First In, First Out)

Example 1: Grocery Store

Visualize a grocery store that employs FIFO for its perishable goods. As new shipments of fresh produce arrive, the store ensures that the older inventory is sold first. In this way, the fruits and vegetables with the earliest expiration dates are prioritized for sale.

Impact: FIFO helps the grocery store maintain the quality of its products and reduce waste by minimizing the chances of older items expiring on the shelves.

Example 2: Automobile Manufacturer

Consider an automobile manufacturer adopting FIFO for its assembly line. The manufacturer strategically uses the first batch of components received in the production process. This means that older, potentially lower-cost materials are utilized before incorporating newer, more expensive ones.

Impact: The application of FIFO allows the automobile manufacturer to present a favorable financial picture by matching revenue with the lower costs associated with the initial batches of components.

LIFO (Last In, First Out)

Example 1:Trendsetting Clothier in the Face of Inflation

Picture a scenario where a high-end retail clothing haven gracefully maneuvers through the intricate dance of inflationary challenges. This particular establishment boasts a commitment to being a trendsetter in the ever-evolving world of fashion, diligently refreshing its inventory with the latest style trends. Now, let’s delve into a circumstance where the expenses tied to clothing witness an upward surge due to the prevailing inflationary pressures.

Impact: This intentional utilization of the LIFO strategy proves to be a linchpin for the boutique. It ensures that the sale of garments harmonizes with the augmented acquisition costs, resulting in a sophisticated and contemporary sales lineup. This deliberate synchronization manifests as a financial advantage, curtailing the reported profit. This financial finesse, in turn, translates into a tangible reduction in taxable income—a sagacious fiscal move, especially resonant in times characterized by the ebb and flow of inflationary forces.

Example 2: Technology Gadgets Manufacturer

Consider a technology gadgets manufacturer using LIFO to manage its raw material inventory. In a situation where the prices of electronic components have surged, the manufacturer applies the LIFO method. The most recently purchased components, with the higher costs, are used in production first.

Impact: By utilizing LIFO, the manufacturer can mitigate the impact of rising material costs on its bottom line, providing a financial cushion against inflationary trends.

FIFO Inventory Method

Fundamentals of FIFO

FIFO, or First In, First Out, operates on a fundamental yet impactful principle: the initial additions to an inventory take precedence in consumption or sale. Put simply, the oldest inventory items find utility or are sold before their newer counterparts. This approach seamlessly aligns with the chronological progression of goods within a business, ensuring that costs linked to the earliest acquisitions harmoniously synchronize with revenue generation.

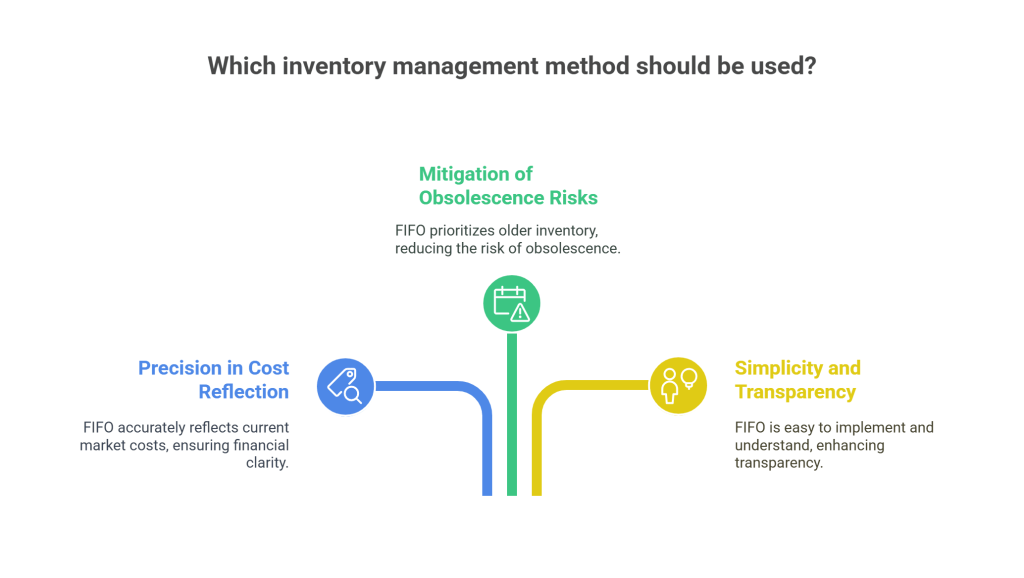

Advantages of FIFO

1. Precision in Cost Reflection:

FIFO stands out by providing a meticulous portrayal of current market costs. Its assumption that the items entering inventory first are the first to be sold ensures a precise reflection of prevailing market expenditures.

2. Mitigation of Obsolescence Risks:

One of FIFO’s notable strengths lies in its adept handling of obsolescence risks. By prioritizing the utilization or sale of older inventory, especially pertinent in industries marked by swift technological or trend shifts, FIFO effectively minimizes the peril of goods becoming obsolete.

3. Elegance in Simplicity and Transparency:

The appeal of FIFO extends to its simplicity in implementation and comprehension. This simplicity translates into transparency in financial reporting, offering a clear and understandable view of inventory management practices.

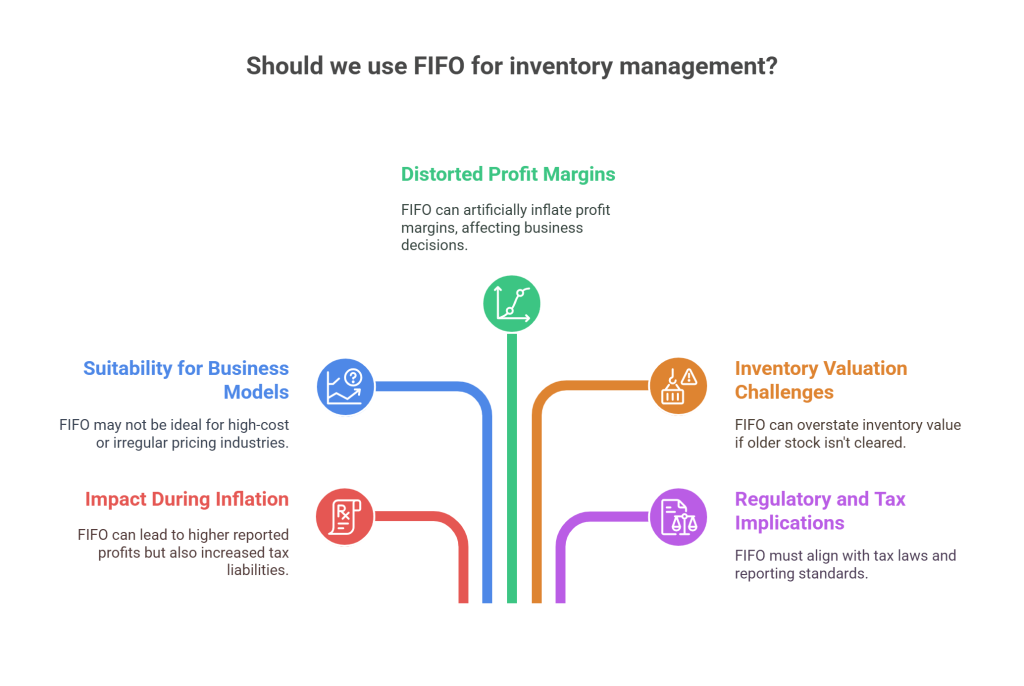

Challenges and Considerations

While FIFO (First-In, First-Out) is a widely adopted inventory management approach, it does come with certain limitations that businesses must carefully consider.

1. Impact During Inflation

In periods of rising prices, FIFO assumes that older, lower-cost inventory is sold first. This results in higher reported profits on paper. Although this may benefit financial reporting, it can also increase taxable income, leading to greater tax liabilities—an important factor for businesses to assess.

2. Not Ideal for All Business Models

FIFO may not be suitable for every industry, particularly those dealing with high-cost goods or products with irregular pricing. In such cases, the financial outcomes produced by FIFO may not accurately reflect current market realities or the true cost of goods sold.

3. Distorted Profit Margins

Because FIFO reflects older inventory costs, it may artificially inflate profit margins during times of cost volatility. This can result in misleading financial indicators, which in turn may affect business decisions related to pricing, investment, or budgeting.

4. Inventory Valuation Challenges

Over time, if older inventory is not cleared out efficiently, FIFO can leave higher-cost, more recent inventory in stock. This may lead to an overstatement of inventory value on the balance sheet, especially in rapidly changing market conditions.

5. Regulatory and Tax Planning Implications

The accounting treatment under FIFO can have implications for tax planning, regulatory compliance, and financial strategy. Companies must ensure that their chosen inventory method aligns with local tax laws and reporting standards.

FIFO Method Example

The FIFO (First In, First Out) inventory method is a dynamic approach to managing inventory, particularly in the retail sector. Let’s explore a different example to grasp how FIFO works in a real-world scenario.

Scenario: Shoe Retailer

Consider a shoe retailer with a diverse inventory of athletic footwear. The retailer regularly receives new stock to keep up with changing trends and customer preferences. Applying the FIFO method ensures a strategic approach to selling shoes while maintaining accurate accounting practices.

Inventory Update:

- Batch 1 (Oldest Inventory): In January, the retailer receives a shipment of running shoes at a cost of $50 per pair.

- Batch 2 (Subsequent Inventory): In March, a new collection of sneakers arrives at a cost of $60 per pair.

- Batch 3 (Latest Inventory): In May, the retailer introduces the latest sports shoe models at a cost of $70 per pair.

Sales Process:

As customers start purchasing shoes, the FIFO method dictates that the oldest inventory (Batch 1) is sold first, followed by Batch 2 and then Batch 3.

Customer Purchase Timeline:

- Customer A (February): Purchases a pair of running shoes for $50. The sale is attributed to Batch 1.

- Customer B (April): Buys a pair of sneakers for $60. The sale is now linked to Batch 2.

- Customer C (June): Opts for the latest sports shoes, paying $70. The sale is associated with Batch 3.

Financial Impact:

- Cost of Goods Sold (COGS): As per FIFO, the cost of goods sold reflects the actual cost of the specific batch of shoes sold. In this example, the older, potentially lower-cost Inventory Accounting is matched with revenue first.

- Impact on Profitability: FIFO, in this case, results in a more accurate reflection of the retailer’s profitability, aligning with the chronological order of inventory acquisition.

Advantages in Retail:

- Minimizing Stale Inventory: FIFO reduces the likelihood of older shoe models becoming outdated or unsellable, ensuring that customers are presented with the latest styles.

- Transparent Financial Reporting: By matching revenue with the costs of the earliest inventory, the retailer provides transparent and accurate financial statements.

- Customer Satisfaction: Customers often prefer purchasing the latest products. FIFO enables the retailer to consistently offer newer items, enhancing customer satisfaction.

LIFO Method Example

The Last In, First Out (LIFO) methodology assumes a pivotal role in the intricate realm of inventory management, particularly within industries susceptible to the undulating currents of cost dynamics. Let us embark on an exploration of a distinctive exemplar, unraveling the operational intricacies that characterize the practical application of LIFO.

Scenario: Electronics Component Manufacturer

Envision a corporate entity specializing in the fabrication of electronic marvels, such as cutting-edge smartphones. In the dynamic landscape of technological evolution, the costs entwined with electronic components experience notable oscillations. It is within this milieu that the LIFO method emerges as an invaluable ally, deftly navigating the undulations of cost volatility.

Inventory Update:

- Latest Batch (Newest Inventory – July): Picture a scenario where the manufacturer secures a consignment of avant-garde processors in July, each carrying a price tag of $200.

- Subsequent Batch (Intermediate Inventory – October): Fast forward to October, and a new era of memory modules graces the inventory shelves, each procured at $150 per unit.

- Initial Batch (Oldest Inventory – April): Travel back to April, and the manufacturer fortuitously stockpiles the prior generation of batteries at a cost of $100 each.

Production and Sales Process:

As the manufacturing ballet unfolds and the symphony of customer orders crescendos, the LIFO directive orchestrates a meticulous choreography. The latest inventory, represented by the July processors, takes center stage, followed by the intermediate October memory modules, and, concluding the performance, the inaugural April batteries.

Customer Order Fulfillment Timeline:

- Customer X (August): A patron orders smartphones in August, triggering the utilization of the Latest Batch of processors, each commanding a price of $200.

- Customer Y (November): Come November, another customer places an order for a distinct model. The manufacturing routine calls for the deployment of the Subsequent Batch of memory modules, each valuated at $150.

- Customer Z (January of the Following Year): In January of the subsequent year, Customer Z places an order necessitating the deployment of the oldest batteries. The Initial Batch, procured at $100 each, takes center stage in the production spectacle.

Financial Impact:

- Cost of Goods Sold (COGS): The LIFO methodology attributes the cost of goods sold to the most recently acquired inventory, mirroring the prevailing market valuations. In this narrative, the COGS aligns seamlessly with the costs associated with the Latest Batch.

- Impact on Profitability: In this narrative, the strategic implementation of LIFO could potentially yield a diminished reported profit owing to the utilization of higher-cost inventory. This, in the short term, bequeaths a tax advantage of strategic significance.

Advantages in Electronics Manufacturing:

- Mitigation of Price Volatility: LIFO emerges as a stalwart ally for the manufacturer, adeptly offsetting the ripples of escalating component costs, thus endowing financial flexibility amid inflationary tempests.

- Tax Planning: By synchronizing revenue with the elevated costs of the most recent inventory, LIFO charts a course towards a reduction in taxable income, affording a strategic vantage point in the labyrinth of tax planning.

- Strategic Cost Management: In an industry characterized by the ephemeral nature of component values, LIFO empowers the manufacturer to strategically navigate costs, adapting to the fluidity of market dynamics with poise and precision.

Conclusion

In conclusion, a nuanced understanding of the difference between LIFO and FIFO is pivotal for making informed financial decisions. The choice should align with the specific circumstances of the company and the prevailing economic conditions. Whether navigating inflation with LIFO or seeking stability through FIFO, the decision becomes a key determinant in optimizing financial outcomes. Elevate your financial strategy with Qodenext.

FAQs: Addressing Common Queries

1. Which Method is Better for Tax Purposes?

The choice between LIFO and FIFO is contingent on the economic environment. LIFO proves advantageous during inflationary periods, acting as a strategic tax planning tool. Conversely, FIFO is the preferred choice in stable or deflationary markets, aligning with a more conservative tax approach.

2. How Do These Methods Impact Financial Statements?

LIFO tends to yield lower reported profits during inflation, directly influencing financial ratios and providing a conservative financial outlook. On the contrary, FIFO tends to generate higher profits during inflationary periods, contributing to a more optimistic representation on financial statements.

3. Can a Company Switch Between LIFO and FIFO?

While it’s technically feasible to switch between LIFO and FIFO, the process is intricate and may carry significant tax implications. To navigate this transition successfully, consulting with financial experts is highly recommended. Their expertise ensures a thorough understanding of potential impacts and aids in making informed decisions.

4. How does FIFO impact financial reporting?

FIFO ensures that the Cost of Goods Sold (COGS) reflects the cost of the oldest inventory first. Consequently, this method often leads to a higher ending inventory value on the balance sheet. This conservative approach contributes to a more prudent and robust financial reporting picture.

5. Can FIFO be applied selectively to specific inventory items?

Absolutely. Businesses have the flexibility to strategically apply FIFO selectively to specific inventory categories. This adaptability allows for nuanced management based on the nature of goods and the dynamic landscape of the market.

6. Can LIFO be used in industries with stable or decreasing costs?

While LIFO traditionally finds its place during inflationary periods, it can technically be implemented in any economic environment. However, businesses should exercise caution, carefully considering the impact on financial reporting and potential tax obligations when opting for LIFO in stable or decreasing cost scenarios.

7. How does LIFO affect cash flow?

LIFO can positively impact cash flow in the short term by attributing higher costs to goods sold. This leads to lower reported profits and, consequently, reduced tax liabilities. It becomes a strategic tool for managing cash flow dynamics in response to fluctuating costs.